Life has its way of throwing us curveballs, and sometimes those curveballs can hit us right in the wallet. Financial slip-ups are nothing to be ashamed of – we’ve all been there! The key is not to stay down but to rise, learn, and conquer. The only way is forward.

So let’s talk about some common financial slip-ups women might face and arm you with a toolkit for bouncing back and mastering your monetary destiny.

Dealing with Debt Dilemmas

Let’s face it; debt is like that unexpected guest who just won’t leave. Whether it’s student loans, credit card debt, or medical bills, it’s easy to feel overwhelmed. First, take a deep breath. You’re not alone. Start by creating a clear picture of your debt – how much you owe and to whom. Then, formulate a strategy.

Prioritize high-interest debt first while making minimum payments on the rest. Consider consolidating your loans or negotiating with creditors for better terms. The journey might be long, but with each payment, you’re one step closer to financial freedom.

Navigating Job Loss

Losing a job can be a devastating blow to your finances and self-esteem. But remember, your job does not define you. Start by assessing your financial situation and cutting unnecessary expenses. Update your resume and network like a pro – your next opportunity might be just a connection away.

In the meantime, consider freelancing, consulting, or exploring a side hustle. Diversifying your income streams not only brings in cash but also builds your skills and resilience.

Navigating Financial Emergencies

Emergencies have a knack for showing up uninvited. Having an emergency fund is your financial safety net. If you haven’t already, start building one. It could be through insurance. This fund can be a lifeline when unexpected expenses strike, keeping you afloat without resorting to loans.

For example, imagine having your car destroyed in an accident. Comprehensive insurance coverage can become your lifeline so you don’t spend your own money on repairs and medical bills.

But some financial emergencies are of no fault of yours. It could be due to someone else’s negligence, such as a drunk driver or surgery gone wrong. Whatever the case, personal injuries can lead to substantial medical expenses and loss of income.

It’s important to have insurance coverage to protect yourself from these financial setbacks. It’s also advisable to have a dedicated lawyer for personal injury claims who can legally help you recover your financial losses due to the unfortunate incident.

Overcoming Under-Earning

Are you earning less than you feel you deserve? Women often face the wage gap, leading to under-earning compared to their male counterparts. But guess what? You’re worth more than your paycheck suggests.

If you believe you’re not being compensated fairly, do your research and prepare to negotiate. Advocate for yourself – don’t be afraid to ask for what you deserve. Invest in your skills and education to increase your value in the job market.

Addressing Retirement Reluctance

Retirement might seem light-years away, but it’s never too early to start planning. Many women prioritize family and caregiving, often neglecting their own retirement savings. Begin by contributing to a retirement account, such as a 401(k) or an IRA.

Take advantage of employer matches – it’s essentially free money. Your future self will thank you for taking the steps now to secure a comfortable retirement.

Conquering Investment Fears

Investing can seem intimidating, but it’s one of the most effective ways to grow your wealth. Start by educating yourself – there are plenty of resources tailored for beginners. Consider enlisting the help of a financial advisor who can guide you through the investment landscape. Remember, investing is a long game – don’t be discouraged by short-term fluctuations.

Learning from Financial Mistakes

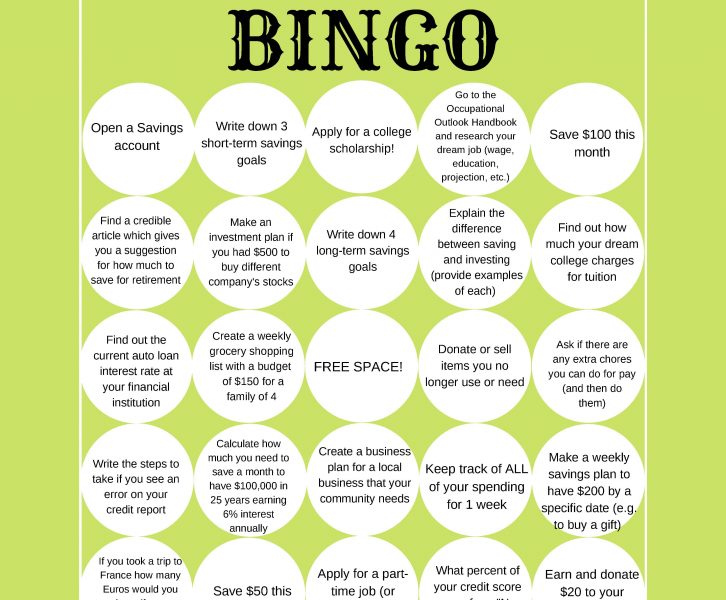

Is impulse spending your greatest challenge? Retail therapy might feel great in the moment, but it can wreak havoc on your budget. If impulse spending keeps recurring, it’s time to take control. Before making a purchase, ask yourself if it’s a want or a need.

Create a budget that allocates a portion of your income for discretionary spending – this way, you can still treat yourself without derailing your financial goals.

Perhaps the most important tool in your monetary mastery toolkit is the ability to learn from your mistakes. We all stumble, but it’s how we rise that truly defines us. Reflect on what led to your financial slip-up and identify ways to avoid it in the future. Seek guidance from mentors, financial experts, and even supportive friends. Remember, you have the power to break bad habits and rewrite your financial story.

Wrapping up

Financial slip-ups are not the end of the world. They’re simply stepping stones on your journey to monetary mastery. Embrace the challenges, learn from your experiences, and keep your eyes on your goals. You have the resilience, strength, and intelligence to overcome anything that comes your way. Let’s bounce back together!